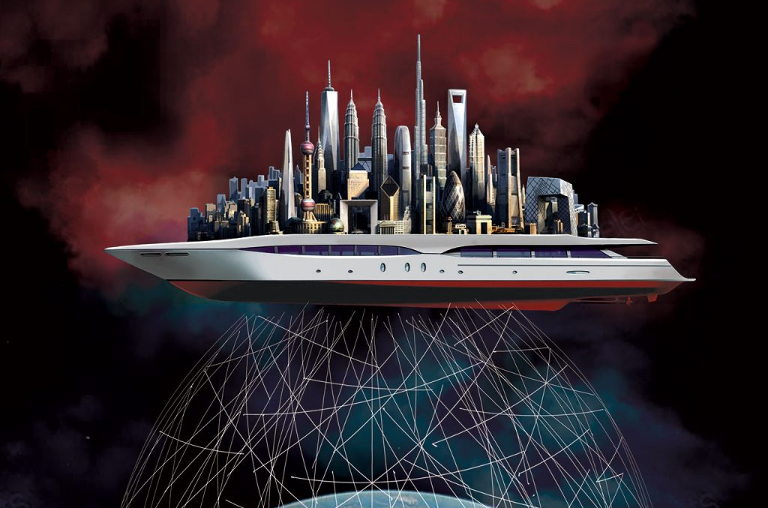

Financial Offshore Structures That Offer Enhanced Versatility for Wealth Holders

Financial Offshore Structures That Offer Enhanced Versatility for Wealth Holders

Blog Article

Checking Out the Trick Advantages of Making Use Of Financial Offshore Solutions

In the world of worldwide financing, the calculated usage of overseas financial solutions presents distinct benefits, particularly in the areas of tax obligation optimization and asset defense. These solutions not only make certain confidentiality but additionally offer a system for varied financial investment chances that can lead to substantial monetary growth.

Tax Obligation Optimization Opportunities in Offshore Jurisdictions

While discovering economic offshore services, one substantial advantage is the tax optimization possibilities available in offshore territories. These areas typically have favorable tax laws created to attract international financial investment, which can considerably decrease the tax obligation burden for corporations and individuals. Numerous offshore monetary facilities enforce no resources gains tax obligations, no inheritance tax obligations, and supply reduced business tax rates. This legal avenue for tax monitoring allows entities and individuals to allocate sources efficiently, possibly boosting productivity and growth.

Furthermore, jurisdictions such as the Cayman Islands, Bermuda, and the Isle of Male are renowned for their affordable tax obligation regimes. They give a legal framework that helps with worldwide company operations without the heavy tax regular in the investors' home countries. Making use of these chances requires cautious planning and adherence to worldwide tax regulations to ensure conformity and make best use of benefits, making the experience of specialized monetary experts critical in navigating the complexities of offshore economic tasks.

Enhancing Privacy and Property Security Via Offshore Provider

Lots of people and corporations transform to overseas solutions not only for tax obligation benefits however also for enhanced personal privacy and property protection. Offshore jurisdictions often have rigorous discretion legislations that avoid the disclosure of financial and individual info to third events. By placing properties in overseas trusts or firms, they can about his lawfully protect their wealth from lenders, suits, or expropriation.

Diversification and Risk Management With International Financial Operatings Systems

Along with improving privacy and property security, offshore monetary solutions offer significant possibilities for diversity and danger monitoring. By designating properties throughout numerous global markets, financiers can decrease the impact of regional volatility and systemic threats. This international spread of financial investments aids reduce potential losses, as unfavorable economic or political developments in one region may be stabilized by gains his comment is here in one more.

Additionally, making use of worldwide economic platforms can use advantageous currency exposure, boosting profile performance with money diversity. This method takes advantage of variations in currency values, possibly countering any kind of residential currency weak points and more maintaining financial investment returns.

Verdict

To conclude, monetary overseas solutions present significant benefits for both people and companies by offering tax obligation optimization, boosted privacy, possession defense, and risk diversification. These solutions assist in tactical monetary planning and can result in significant growth and preservation of wealth. By leveraging the one-of-a-kind benefits of offshore territories, stakeholders can accomplish a much more effective and secure monitoring of their funds, tailored to their certain requirements and objectives.

In the world of international finance, the strategic usage of offshore monetary services like it offers distinctive benefits, especially in the locations of tax obligation optimization and possession protection.While exploring economic overseas services, one considerable benefit is the tax obligation optimization chances offered in offshore territories. Numerous offshore economic centers impose no resources gets taxes, no inheritance taxes, and offer low business tax prices - financial offshore. Making use of these possibilities needs cautious planning and adherence to worldwide tax legislations to ensure compliance and make best use of benefits, making the expertise of specialized economic advisors critical in navigating the complexities of overseas monetary activities

Report this page